---

---

---

About Me

- Asderathos

- Lift your lamp beside the golden door, Break not the golden rule, avoid well the golden calf, know; not all that glitters is gold, and laissez faire et laissez passer [let do and let pass] but as a shining sentinel, hesitate not to ring the bell, defend the gates, and man the wall

External Links

- Academic Bill of Rights

- American Form of Govt. by JBS

- American Revival [Binder]

- American Thinker

- Areopagitica by John Milton

- Asderathos' Lexicon

- Canada Free Press

- Cato Institute

- Democracy In America by de Tocqueville

- Federalist Papers

- Front Page Magazine

- Michelle Malkin

- New Zeal

- News Busters

- Right Scoop

- The Blaze.com

- Two Treatises of Government by Locke

- YouTube: Cato Video

- YouTube: Chris Christie

- YouTube: Jim DeMint

- YouTube: Lee Doren HTWW

- YouTube: News Busted

- YouTube: Paul Ryan

- YouTube: PJ TV

- YouTube: Ron Paul

- YouTube: Steven Crowder

- YouTube: Tom McClintock

Saturday, August 21, 2010

Monday, August 9, 2010

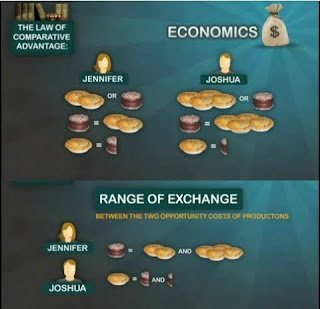

Opportunity Cost and The Law of Comparative Advantage

|

| Opportunity Cost (Wikipedia) |

The cost related to the next-best choice available to someone who has picked between several mutually exclusive choices. Opportunity cost plays a crucial part in ensuring that scarce resources are used efficiently.

Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of forgone output, lost time, pleasure or any other benefit that provides utility-[Economically a measure of relative satisfaction.] should also be considered opportunity costs.

The consideration of opportunity costs is one of the key differences between the concepts of economic cost and accounting cost. Assessing opportunity costs is fundamental to assessing the true cost of any course of action. In the case where there is no explicit accounting or monetary cost (price) attached to a course of action, or the explicit accounting or monetary cost is low, then, ignoring opportunity costs may produce the illusion that its benefits cost nothing at all. The unseen opportunity costs then become the implicit hidden costs of that course of action.

Opportunity cost is assessed in not only monetary or material terms, but also in terms of anything which is of value. For example, a person who desires to watch each of two television programs being broadcast simultaneously, and does not have the means to make a recording of one, can watch only one of the desired programs. Therefore, the opportunity cost of watching Dallas could be enjoying Dynasty. Of course, if an individual records one program while watching the other, the opportunity cost will be the time that that individual spends watching one program versus the other.

_____________________________________________________

|

| The Law of Comparative Advantage (Wikipedia) |

The ability of a party to produce a particular good or service at a lower opportunity cost than another party IE the highest relative efficiency, given all the other products that could be produced.

It can be contrasted with absolute advantage which refers to the ability of a party to produce a particular good at a lower absolute cost than another.

Comparative advantage explains how trade can create value for both parties even when one can produce all goods with fewer resources than the other. The net benefits of such an outcome are called gains from trade. It is the main concept of the pure theory of international trade.

__________________________________________________________________________________

Example

Two men live alone on an isolated island. To survive they must undertake a few basic economic activities like water carrying, fishing, cooking and shelter construction and maintenance. The first man is young, strong, and educated. He is also faster, better, and more productive at everything. He has an absolute advantage in all activities. The second man is old, weak, and uneducated. He has an absolute disadvantage in all economic activities. In some activities the difference between the two is great; in others it is small.

Despite the fact that the younger man has absolute advantage in all activities, it is not in the interest of either of them to work in isolation since they both can benefit from specialization and exchange. If the two men divide the work according to comparative advantage then the young man will specialize in tasks at which he is most productive, while the older man will concentrate on tasks where his productivity is only a little less than that of the young man. Such an arrangement will increase total production for a given amount of labor supplied by both men and it will benefit both of them.

__________________________________________________________________________________

Comparative advantage was first described by Robert Torrens in 1815 in an essay on the Corn Laws. He concluded it was to England's advantage to trade with Portugal in return for grain, even though it might be possible to produce that grain more cheaply in England than Portugal.

However, the concept is usually attributed to David Ricardo who explained it in his 1817 book On the Principles of Political Economy and Taxation in an example involving England and Portugal.[3] In Portugal it is possible to produce both wine and cloth with less labor than it would take to produce the same quantities in England. However the relative costs of producing those two goods are different in the two countries. In England it is very hard to produce wine, and only moderately difficult to produce cloth. In Portugal both are easy to produce. Therefore while it is cheaper to produce cloth in Portugal than England, it is cheaper still for Portugal to produce excess wine, and trade that for English cloth. Conversely England benefits from this trade because its cost for producing cloth has not changed but it can now get wine at a lower price, closer to the cost of cloth. The conclusion drawn is that each country can gain by specializing in the good where it has comparative advantage, and trading that good for the other.

However, the concept is usually attributed to David Ricardo who explained it in his 1817 book On the Principles of Political Economy and Taxation in an example involving England and Portugal.[3] In Portugal it is possible to produce both wine and cloth with less labor than it would take to produce the same quantities in England. However the relative costs of producing those two goods are different in the two countries. In England it is very hard to produce wine, and only moderately difficult to produce cloth. In Portugal both are easy to produce. Therefore while it is cheaper to produce cloth in Portugal than England, it is cheaper still for Portugal to produce excess wine, and trade that for English cloth. Conversely England benefits from this trade because its cost for producing cloth has not changed but it can now get wine at a lower price, closer to the cost of cloth. The conclusion drawn is that each country can gain by specializing in the good where it has comparative advantage, and trading that good for the other.

Subscribe to:

Comments (Atom)